How much can i borrow on top of my mortgage

These covers are designed to offer some financial protection against the unexpected. Rate applies for new loans when you borrow up to 60 of the property value with a principal and interest repayment variable rate loan.

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Usually banks and building societies will offer up to four-and-a-half times the annual income of you and anyone you are buying with.

. How do lenders decide how much I can borrow. Affordability calculator get a more accurate estimate of how much you could borrow from us. VA Mortgage Calculator How Much Can I Afford with a VA Loan.

Use the following calculator to determine the maximum monthly payment PI and the maximum loan amount for which you may qualify. The row across the top are different interest rates between 4 and 5. Subject to change without notice.

Before you invest 300k into a home youll want to be sure you can afford it. FHA loans generally require lower down payments as low as 35 of the home value while other loan types can require up to 20 of the home value as a minimum down payment. Use Zillows affordability calculator to estimate a comfortable mortgage amount based on your current budget.

Make your money go further. The type of mortgage you choose can have a dramatic impact on the amount of house you can afford especially if you have limited savings. The longer term will provide a more affordable monthly.

How long will I live in this home. Your salary will have a big impact on the amount you can borrow for a mortgage. Its important to calculate your monthly income and expenses carefully to avoid winding up with a mortgage loan you cant pay in the long run.

I used rates between 4 and 5 because mortgage rates are currently hovering. The VA loan affordability calculator is set to the top end of the VAs recommended DTI ratio of 41 percent. Find out how much you could borrow for a mortgage compare rates and calculate monthly costs using our mortgage calculator.

The table below shows the top 10 most affordable markets to live in among the nation. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. The comparison rates are based on a loan for 150000 and a term of 25 years.

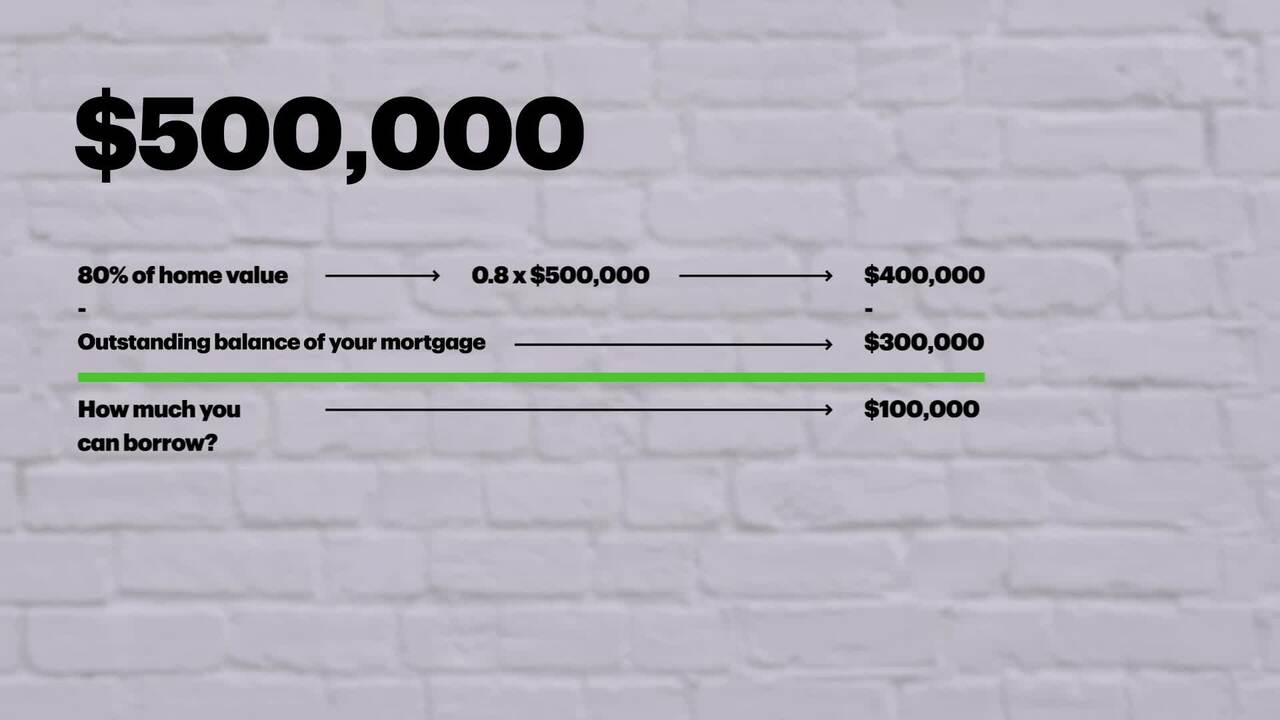

To be able to borrow a 300k mortgage youll require an income of 92287 per year. If you have at least 20 equity in your home you may be able to get a home equity line of credit. Enter the loans interest rate if it doesnt come with any fees under Interest rateNote that your monthly mortgage payments will vary depending on your interest rate taxes PMI costs and other related fees.

Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out. How much house you can afford will mainly depend on the following. How much can I borrow.

Consider some options like. You could consider taking out life or life and critical illness insurance alongside your mortgage. Mortgage calculator Mortgage repayment calculator Stamp duty calculator.

Your monthly mortgage payment is going to take up a good chunk of your overall debt so anything you can do to lower that payment can help. Mortgage rates are at their highest level in years and expected to keep rising. And if youre ready to buy visit our best mortgage lenders page to find the right lender for you.

Your loan amount and mortgage term. Enter how much you want to borrow under Loan amount. It is more important than ever to check your rates with multiple.

The Ascents Best Mortgage Lender of 2022. On top of the rate youll need to factor in things such as up-front fees early repayment charges and how many years you want to take to pay back the loan the mortgage term. See how much you can borrow.

The usual rule of thumb is that you can afford a mortgage two to 25 times your income. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. Your loved ones would receive a lump-sum payment if you died and depending on your cover could receive a lump sum if you were diagnosed with a critical illness.

The income you need is calculated using a 300k mortgage on a payment that is 24 of your monthly income. It takes about five to ten minutes. Your total interest on a 600000 mortgage.

How much income do I need for a 300k mortgage. Find the best deals. How Much Mortgage Can I Afford if My Income Is 60000.

At 60000 thats a 120000 to 150000 mortgage. Enter details about your income down payment and monthly debts to determine how much to spend on a house. That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term.

Multiply these savings by the entire life of a 30-year loan and shed potentially save enough to purchase a car pay for a college education or even make major renovations or additions to the home. Find a less expensive house. Please get in touch over the phone or visit us in branch.

Thats about two-thirds of what you borrowed in interestIf you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. Type in your mortgage term in years not months under the Loan terms field. Our mortgage calculators can give you a rough idea of how much you could borrow for your mortgage by taking the above factors into consideration.

Offset calculator see how much you could save. As you can see savings stand to be well over 1000 in just the first year of Taylors home ownership alone. Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments.

In short the difference that a 1 increase in mortgage. Find out how much you could borrow with a home equity line of credit based on your homes. Interest rates are also a consideration and in most cases mortgage lenders will ensure you will still be able to repay the amount you borrow if interest rates were to increase.

The first column is the loan amount or how much you borrow from the bank.

How To Get A Mortgage Without Financially Freaking Out Mortgage Tips Freak Out Mortgage

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Understand Your Interest Rate Land Loan Farm Loan Farm

Getting A Second Mortgage Td Canada Trust

/dotdash-title-loans-vs-payday-loans-which-are-better-Final-a61111fe80ff4f4f9a9b0eb9428ba803.jpg)

Title Loans Vs Payday Loans What S The Difference

Mortgage Tax Credit Recapture Mcc Nchfa Nc Mortgage Experts First Home Buyer Tax Credits First Time Home Buyers

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

How To Increase The Amount You Can Borrow My Simple Mortgage

Personal Loan Should I Take One Personal Loans Finance Loans Loan

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

Dailyui 004 Mortgage Calculator Mortgage Amortization Calculator Mortgage Calculator Mortgage Loan Calculator

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

How To Borrow Money For A Down Payment Loans Canada

Answer To Crespo Here S How Much You Should Consider Borrowing From Your Retirement Plan To Buy A Home Allaboutmortg Video In 2022 The Borrowers Mortgage Tips Home Buying

Mortgage Refinance Td Canada Trust

Pin On Money Saving Tips

:max_bytes(150000):strip_icc()/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Pre Qualified Vs Pre Approved What S The Difference